The best bank in the US is JPMorgan Chase & Co. The Bank of America is another major player in the US banking sector founded in 1904.

The following list accumulates the latest data of the biggest banks in the United States as of June 30, 2023, recorded by the Federal Financial Institutions Examination Council based on their total assets.

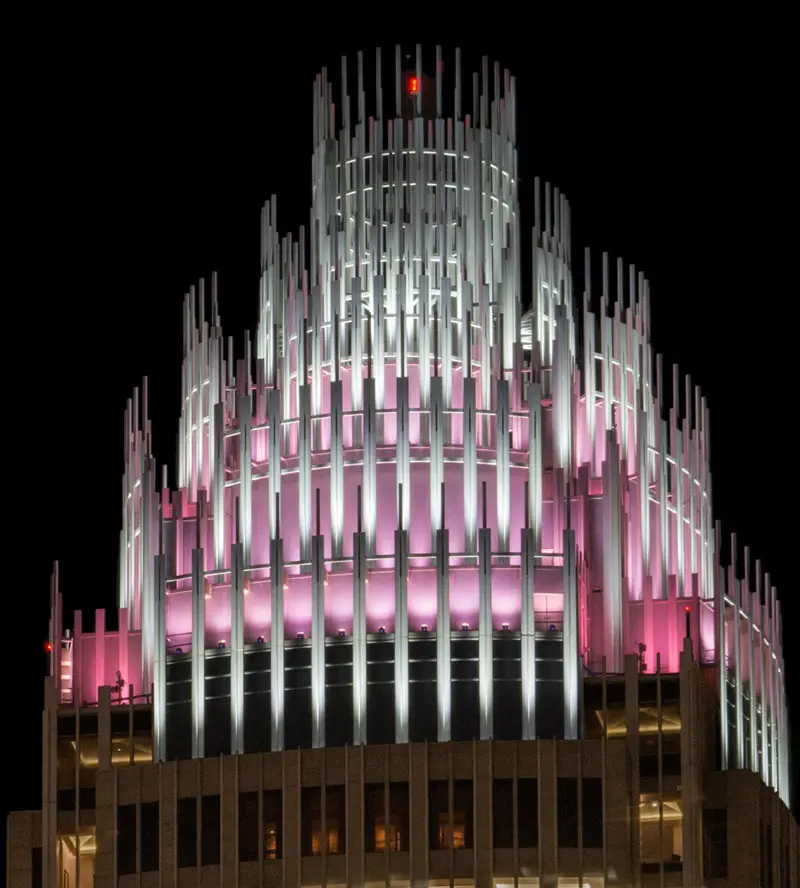

1. JPMorgan Chase & Co

The multinational financial services powerhouse is headquartered in New York City. As one of the largest and most influential banks in the world, JPMorgan operates in various segments, including investment banking, asset management, retail banking, and private banking.

The firm has a rich history dating back to the 19th century, with roots tracing back to the founding of the Bank of the Manhattan Company in 1799.

- Total Asset: $3,868 (billions of US dollars)

- Market Capitalization: $430.973 (billions of US dollars)

2. Bank of America

One of the top 5 banks in the US is Bank of America. Established in 1904 as the Bank of Italy by Amadeo Pietro Giannini, the institution aimed to serve the needs of immigrants who faced challenges in accessing financial services.

Over the years, through a series of mergers and acquisitions, it evolved into the Bank of America we know today. With its headquarters in Charlotte, North Carolina, the bank operates a vast network of branches and ATMs, making it a ubiquitous presence in communities across the nation.

- Total Asset: $3,123 (billions of US dollars)

- Market Capitalization: $252.05 (billions of US dollars)

3. Citigroup

Here we have another of the biggest banks in the US, Citigroup. With a rich history dating back to the early 19th century, it is headquartered in New York City. Citigroup operates in over 100 countries, providing various financial products and services.

Citigroup's global presence and diversified business segments contribute to its status as a key player in the financial industry. Its commitment to technological advancements and digital transformation has positioned it as a leader in the financial technology space.

- Total Asset: $2,423 (billions of US dollars)

- Market Capitalization: $91.89 (billions of US dollars)

4. Wells Fargo & Company

Recognized as one of the oldest financial institutions in the United States, it has a rich history dating back to its founding in 1852 during the California Gold Rush. Wells Fargo played a pivotal role in the economic development of the American West.

Originally established as a stagecoach and banking company to cater to the burgeoning population seeking fortune in the goldfields. The company has adapted to the changing landscape of banking and finance, embracing digital technologies.

- Total Asset: $1,876 (billions of US dollars)

- Market Capitalization: $167.58 (billions of US dollars)

5. Goldman Sachs

Founded in 1869 by Marcus Goldman, the firm has made its name as one of the big banks in the us and the largest investment banks globally. The global investment banking and financial services powerhouse is headquartered in New York City.

The firm has invested in cutting-edge technologies, recruited top talent in the fields of data science and artificial intelligence, and explored new avenues such as digital banking.

- Total Asset: $1,571 (billions of US dollars)

- Market Capitalization: $118.10 (billions of US dollars)

6. Morgan Stanley

With its headquarters in New York City, Morgan Stanley operates a vast network of branches and offices across the globe, strategically positioning itself to serve a diverse clientele of corporations, governments, institutions, and individuals.

Founded in 1935, the bank has been involved in some of the most significant deals globally, contributing to its reputation as a top-tier investment bank. It has a robust wealth management business, providing a wide array of services to high-net-worth individuals and institutions.

- Total Asset: $1,164 (billions of US dollars)

- Market Capitalization: $151.00 (billions of US dollars)

7. U.S. Bancorp

With a rich history dating back to 1863, U.S. Bancorp has evolved over the years through mergers and acquisitions, solidifying its position as a key player in the financial sector. It is headquartered in Minneapolis, Minnesota.

The bank has consistently received recognition for its ethical standards and transparency in its operations. Its dedication to maintaining a strong ethical framework has not only contributed to its reputation but has also earned the trust of its customers and stakeholders.

- Total Asset: $680 (billions of US dollars)

- Market Capitalization: $59.65 (billions of US dollars)

8. PNC Financial Services Group, Inc

You can definitely count on PNC Financial Services Group among the biggest US banks. PNC has evolved into one of the most respected banks with its commitment to customer-centric solutions and innovation.

The American diversified financial services company is headquartered in Pittsburgh, Pennsylvania. PNC has successfully navigated the complex landscape of mergers and acquisitions, demonstrating its ability to integrate and leverage synergies to create value for both shareholders and customers.

- Total Asset: $558 (billions of US dollars)

- Market Capitalization: $53.78 (billions of US dollars)

9. Truist Financial

Truist Financial Corporation is a prominent American financial services company formed as a result of the merger between BB&T Corporation and SunTrust Banks, Inc. The merger was completed in December 2019, and the combined entity officially adopted the name Truist Financial Corporation.

Headquartered in Charlotte, North Carolina, Truist has quickly established itself as one of the largest banks in the United States, with a significant presence across the Southeast, Mid-Atlantic, and beyond.

- Total Asset: $554 (billions of US dollars)

- Market Capitalization: $43.53 (billions of US dollars)

10. TD Bank

Known for its green branding and iconic TD shield logo, the bank operates with a focus on providing a diverse range of financial products and services to individuals, businesses, and institutions.

The bank boasts an extensive network of branches along the East Coast, offering in-person services to customers. Additionally, TD Bank has embraced technological advancements, providing a robust online and mobile banking platform.

- Total Asset: $516 (billions of US dollars)

- Market Capitalization: $119.26 (billions of US dollars)

11. Charles Schwab Corporation

The Charles Schwab Corporation was founded in 1971 by Charles R. Schwab. The company has been a pioneer in leveraging technology to enhance the client experience, offering online trading platforms and tools that cater to both seasoned investors and beginners alike.

Headquartered in San Francisco, California, the company has played a significant role in revolutionizing the investment industry by introducing a discount brokerage model.

- Total Asset: $511 (billions of US dollars)

- Market Capitalization: $119.56 (billions of US dollars)

12. Capital One Financial Corporation

Established in 1988 and headquartered in McLean, Virginia, Capital One has grown to become one of the largest banks in the United States. The company leverages advanced analytics and machine learning to assess risk.

The bank is particularly recognized for its expertise in credit cards, auto loans, banking, and other financial products, catering to a broad spectrum of consumer and commercial needs.

- Total Asset: $467 (billions of US dollars)

- Market Capitalization: $44.23 (billions of US dollars)

13. The Bank of New York Mellon

The BNY Mellon was established in 1784 by Alexander Hamilton and is headquartered in New York City. Its influence extends beyond the United States, with a significant international presence, serving clients in more than 100 markets worldwide.

BNY Mellon is deeply ingrained in the global financial ecosystem, fostering economic growth and stability through its diverse range of services. The bank continually invests in cutting-edge solutions to enhance efficiency and client experience.

- Total Asset: $430 (billions of US dollars)

- Market Capitalization: $35.03 (billions of US dollars)

14. State Street Corporation

Founded in 1792, the corporation has a significant global presence with offices and operations in key financial hubs across North America, Europe, Asia, and the Middle East. It is headquartered in Boston, Massachusetts.

The core business of State Street revolves around providing a range of financial services, including investment management, securities lending, and custody and administration services for institutional investors.

- Total Asset: $294 (billions of US dollars)

- Market Capitalization: $23.93 (billions of US dollars)

15. BMO US

The Bank of Montreal (BMO) is one of Canada's leading financial institutions that has a significant presence in the United States. The bank leverages advanced technologies to enhance its digital banking platforms, making it easier for customers to manage their finances online.

With a focus on building long-term relationships, BMO USA aims to provide personalized solutions and advice to help clients achieve their financial goals.

- Total Asset: $293 (billions of US dollars)

- Market Capitalization: $65.43 (billions of US dollars)