Planning to invest in mutual funds? Mutual funds have huge potential, but selecting the right ones that align with your financial goals can be challenging.

Whether you're a beginner or an experienced investor, this guide will help navigate the options. Make informed decisions and optimize your investment journey with the guidance offered in this comprehensive article. Without further ado, let's find out the best mutual funds in 2024.

What Are Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. Investors own shares in the fund, and the value of those shares fluctuates with the fund's performance.

Professional fund managers make investment decisions on behalf of the investors. They provide diversification, liquidity, and the expertise of professional management, making them a popular choice for investors seeking a simple and collective investment option.

How To Choose The Best Mutual Funds

Choosing the best mutual funds involves considering several factors to align with your financial goals and risk tolerance. Here are steps to guide you:

- Define Goals and Risk Tolerance: Clearly state investment objectives and assess comfort with risk.

- Research Performance: Evaluate historical fund performance for consistency.

- Consider Costs: Note expense ratios and fees, opting for competitive rates.

- Diversification: Choose funds with a diverse portfolio aligning with risk tolerance.

- Review Fund Management: Investigate the manager's expertise and consistency.

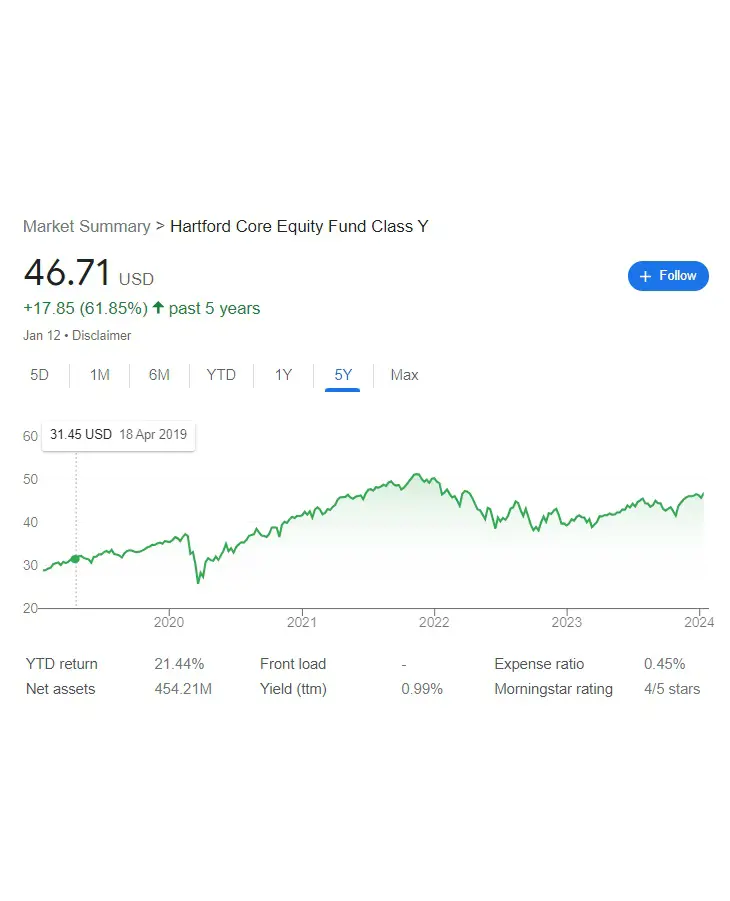

The Hartford Core Equity Fund (HGIYX)

One of the best stocks to invest in 2024 on the list of Forex, HGIYX is the perfect investment for investors looking for a large-cap growth fund with a strong historical performance. It is characterized by an expense ratio of 0.45%, reflecting the annual fee investors incur.

With a dividend yield of 0.99%, the fund has a 5-year average annual return of 91.32%. The return is significantly higher than the S&P 500's average return over the same period. The fund invests in a variety of industries and companies, which can help to reduce risk.

- 10-Year Average Annual Return: 11.91%

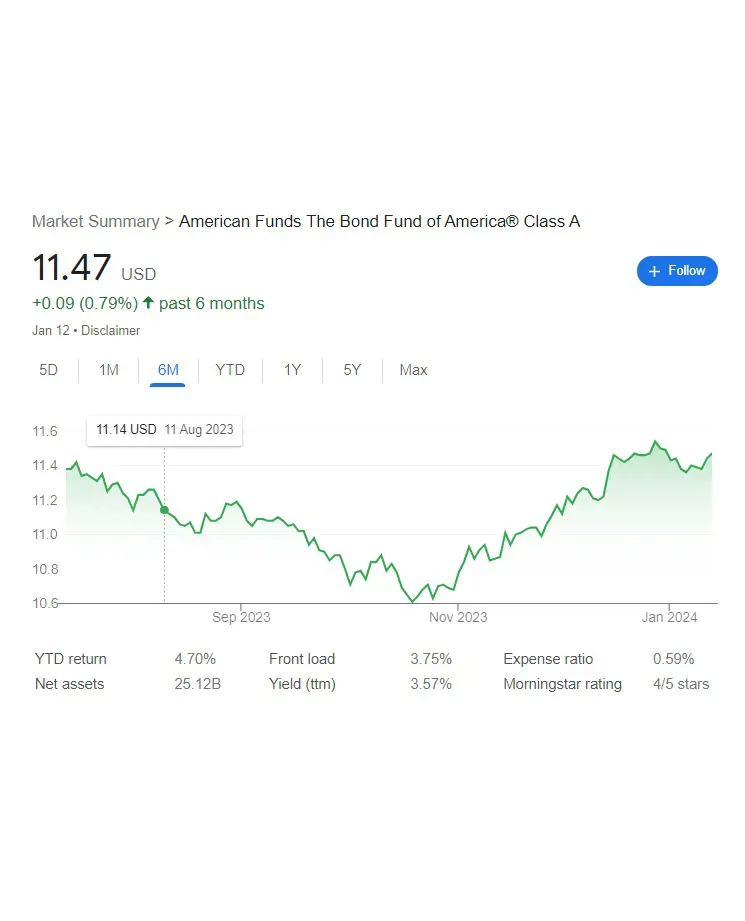

American Funds Bond Fund of America

The American Funds Bond Fund of America sounds like a potentially interesting option for someone looking for income from their bond investments. It is a well-established, reputable investment firm with a long track record of managing bond funds.

Having an expense ratio of 0.59%, it is fairly typical for actively managed bond funds. A 3.57% yield is higher than what many other bond funds are currently offering, which could be attractive for income-oriented investors.

- 10-Year Average Annual Return: 4.32%

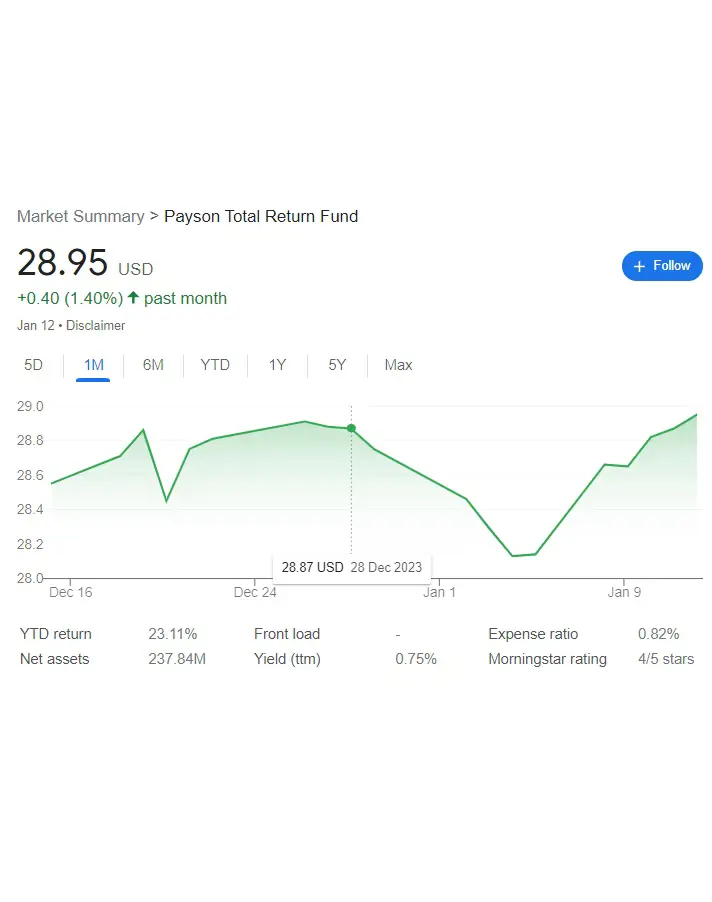

Payson Total Return

Payson Total Return has a strong track record and could be a valuable addition to a diversified portfolio for investors seeking both income and capital appreciation. However, carefully consider your circumstances and risk tolerance before making any investment decision.

In 2023, the fund delivered a 19.62% return, outperforming many peers and the market average. With a long-term record of success, it invests in a blend of stocks and convertible securities, aiming for both income and capital appreciation.

- 5-Year Average Annual Return: 13.38%

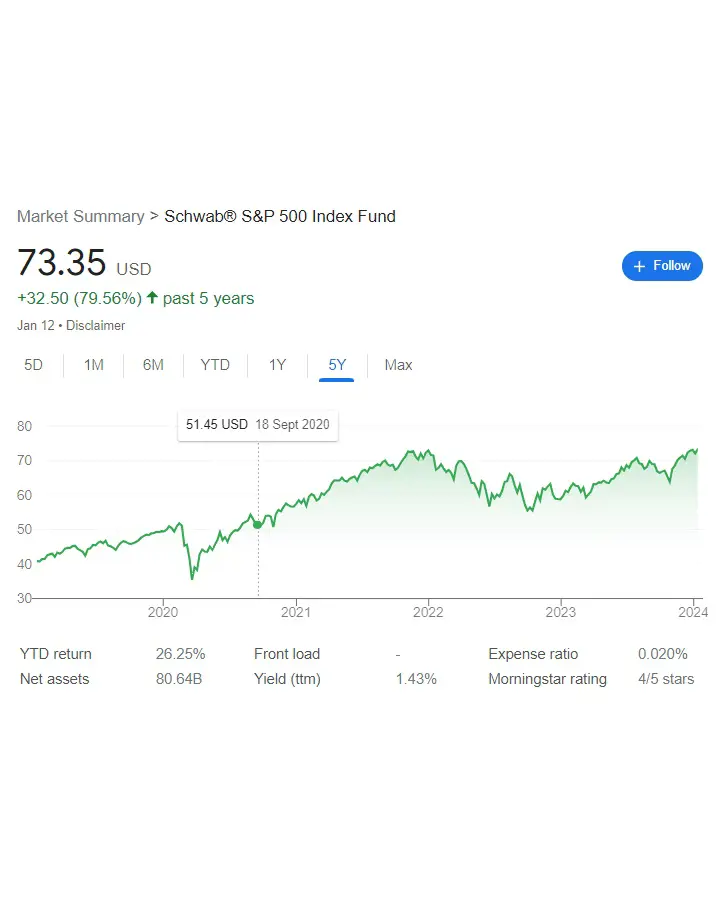

Schwab S&P 500 Index Fund (SWPPX)

SWPPX provides broad exposure to 500 leading U.S. companies, representing around 80% of the market. It eliminates the need for stock picking, offering a low-maintenance investment approach.

Noteworthy is its exceptionally low expense ratio of 0.02%. With no minimum investment requirement and widespread availability, it caters to both novice and seasoned investors. Historically, SWPPX closely mirrors the S&P 500, delivering consistent broad-market returns.

- 10-Year Average Annual Return: 7.98%

Vanguard Total Stock Market Index Fund

With diversified exposure to large, mid, and small-cap companies across sectors, the Vanguard Total Stock Market minors the entire US market. Boasting a low 0.04% expense ratio, it minimizes fees impacting returns.

As a passively managed fund, it reduces tracking errors and transaction costs compared to active counterparts. It's accessible to all, with no minimum investment requirement and broad availability, making it an attractive option for investors seeking stable, cost-effective participation.

- 10-Year Average Annual Return: 9.72%

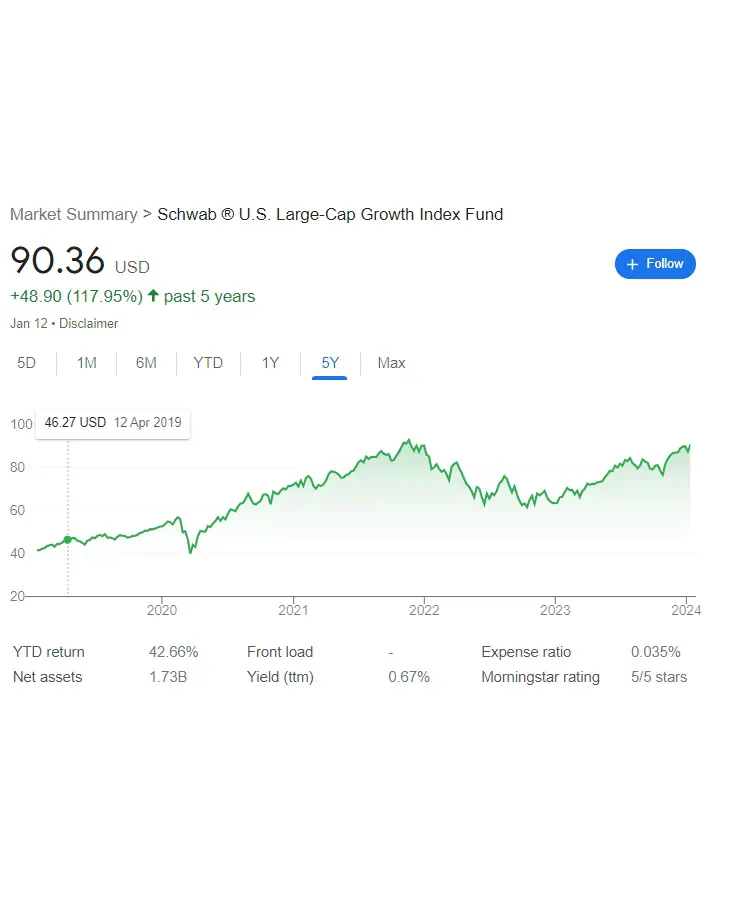

Schwab U.S. Large-Cap Growth Index Fund (SWLGX)

The SWLGX emphasizes targeted growth by tracking the Russell 1000 Growth Index, investing in companies expected to outpace the market. With a dividend yield of 0.67%, the fund exhibited strong performance, returning +42.66% in 2023.

This best dividend mutual funds maintains a competitive edge with a low expense ratio of 0.035%, reducing fees. While prioritizing growth, SWLGX ensures diversification by holding a variety of large-cap stocks, helping to mitigate risks associated with individual companies.

- Avg. Ann. Return Since Inception (December 2017): 15.45%

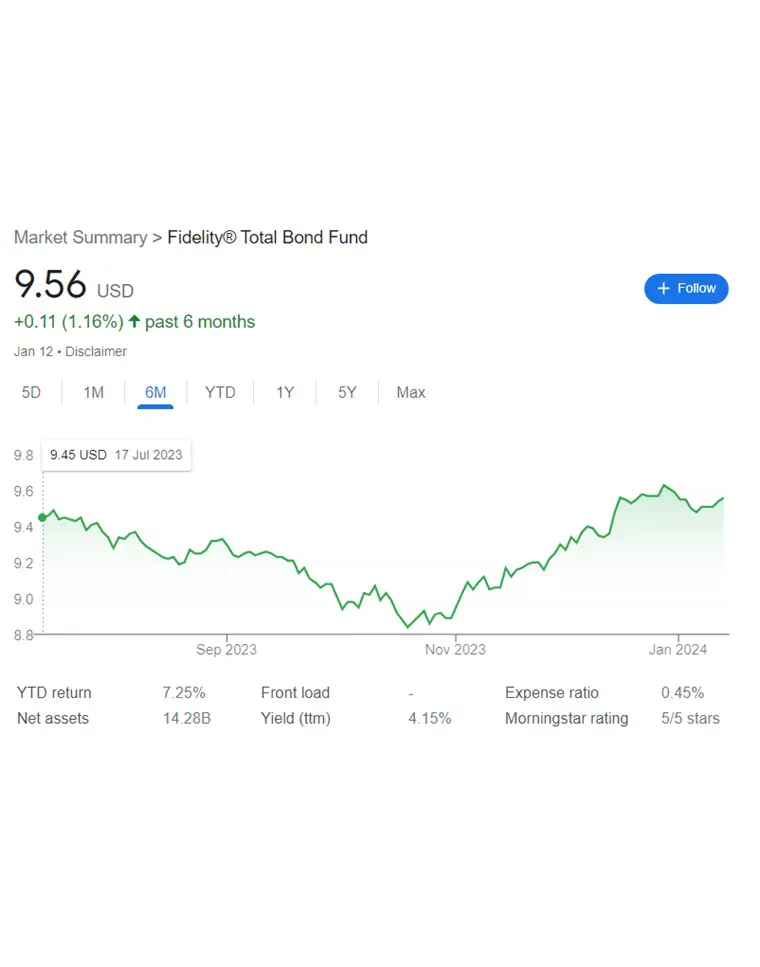

Fidelity Total Bond (FTBFX)

Boasting a 30-day yield of 8.11% in December 2023, this bon offers more than many other bond funds. With a reasonable expense ratio of 0.45%, it maintains an attractive balance between returns and costs.

The fund prioritizes broad diversification by investing in a variety of debt securities, including investment-grade, high-yield, and emerging market bonds. FTBFX allows flexible allocation, with up to 20% of assets in lower-quality debt securities, potentially enhancing returns.

- 5-year average return: 3.31%

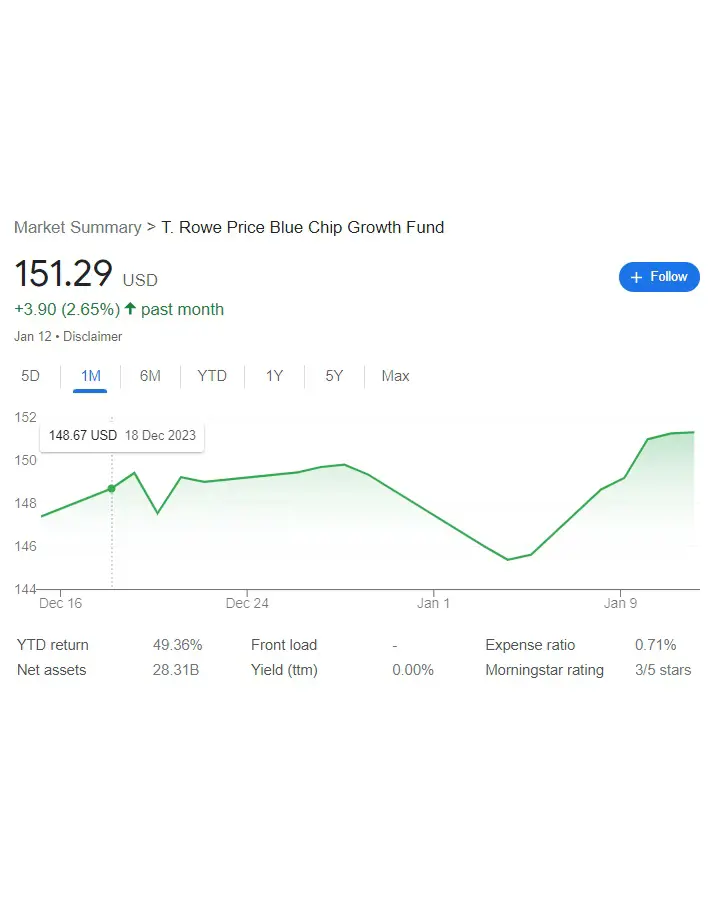

T. Rowe Price Blue Chip Growth Fund (PRGTX)

With a consistent track record of outperformance, the T. Rowe Price Blue Chip Growth Fund (PRGTX) delivered an impressive 35.43% return in 2023, surpassing the S&P 500's 26%. The fund's focus on blue-chip growth involves strategic investments in established.

PRGTX benefits from experienced and successful fund management. Despite being an actively managed fund, PRGTX maintains a relatively competitive edge with a moderate expense ratio of 0.71%, striking a balance between performance and cost for discerning investors.

- 10-Year Average Annual Return: 12.55%

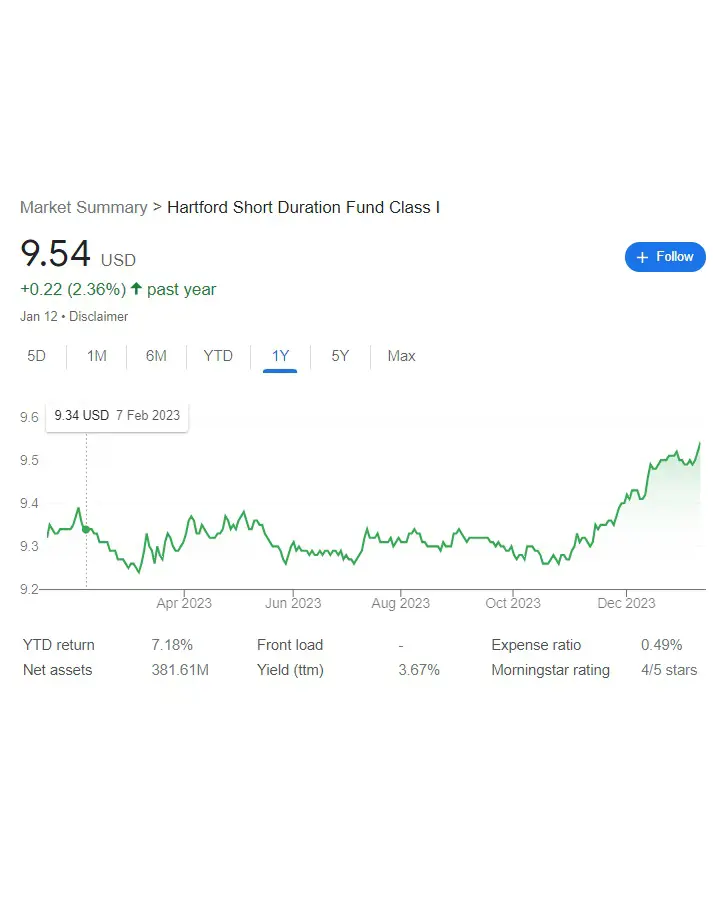

The Hartford Short Duration Fund (HSDIX)

Primarily focused on bonds with shorter maturities, HSDIX distinguishes itself by being less sensitive to interest rate fluctuations, especially in comparison to funds with longer maturities. This characteristic becomes advantageous in environments where interest rates are on the rise.

Offering an income potential, HSDIX boasts a decent current yield of 4.62% with an expense ratio of 0.49%. The relative stability of short-term bonds, presenting lower volatility compared to their longer-term counterparts, positions HSDIX as a potentially stable option.

- 10-Year Avg. Ann. Return: 2.05%

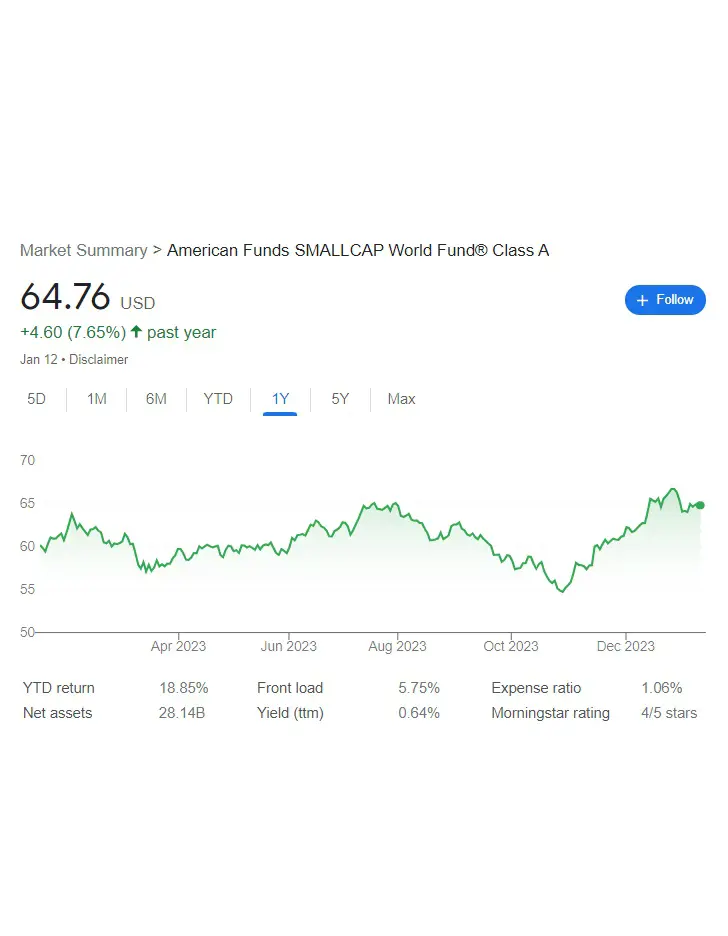

American Funds Smallcap Growth Fund (AMSCG)

AMSCG is a mutual fund specializing in the stocks of small, rapidly growing U.S. companies. With outperformance, particularly in bullish market conditions, it has achieved an impressive average annual return of 15.2% over the past decade, surpassing the S&P 500 index's 9.5%.

The fund is overseen by a seasoned team of investment professionals, with lead portfolio manager Michael Douglass boasting over two decades of experience. While AMSCG's expense ratio stands at 1.06%, slightly above the small-cap growth fund average, its historical performance has often justified the higher fees for many investors.

- 5-Year Average Annual Return: 8.93%

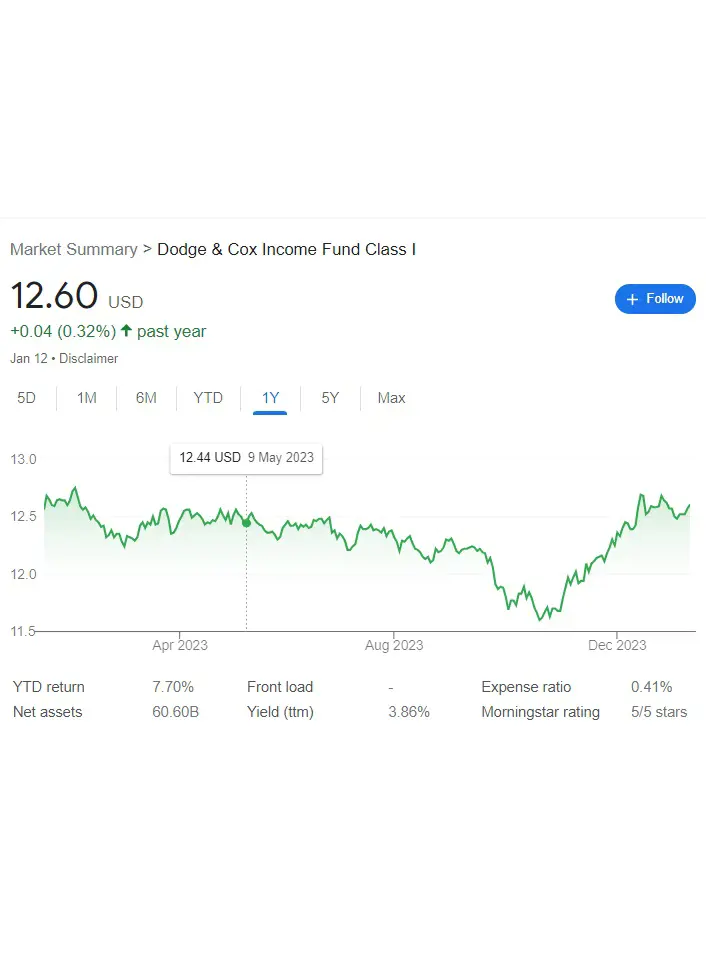

Dodge & Cox Income Fund (DODIX)

DODIX, characterized by a skilled and long-tenured management team, benefits from its proven track record in effective security selection and market navigation. The fund stands out for its cost-effectiveness, with a low expense ratio of 0.41%.

Diversification is a key strength, as DODIX holds a broad array of investment-grade debt securities, spanning government bonds, mortgage-backed securities, and corporate bonds. In terms of interest rate exposure, the fund strategically focuses on intermediate-term bonds with maturities ranging from 3 to 10 years.

- 10-Year Average Annual Return: 2.70%

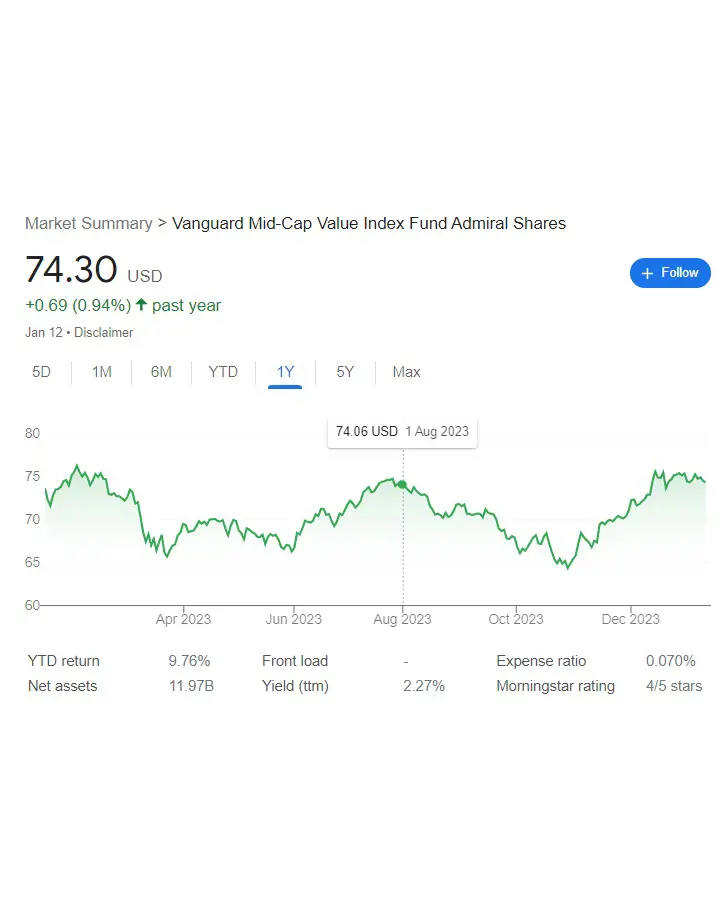

Vanguard Mid-Cap Value Index Fund (VMVAX)

Tracking the CRSP US Mid Cap Value Index, it offers broad diversification by exposing investors to a varied portfolio of mid-cap value stocks across multiple sectors. This approach minimizes single-stock risk and aims to deliver market-like returns.

Sporting a low expense ratio of 0.07%, the fund taps into the long-term advantages of value stocks, which are often undervalued by the market. Additionally, as a mutual fund, VMVAX provides liquidity, facilitating easy buying and selling at the end of each trading day.

- 10-Year Avg. Ann. Return: 8.56%

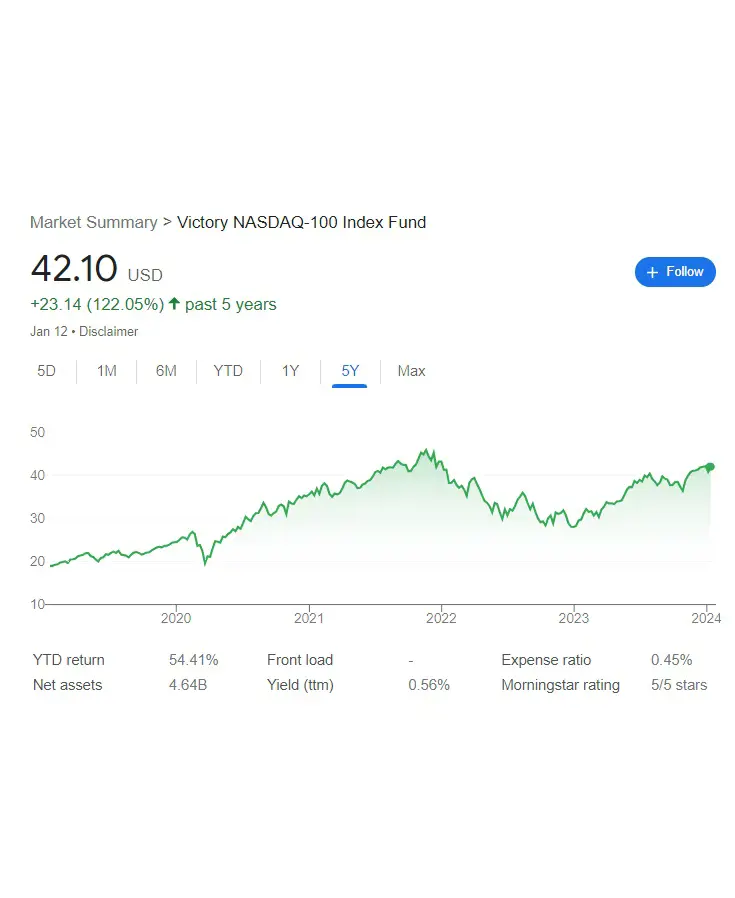

Victory Nasdaq-100 Index Fund (USNQX)

USNQX offers service to some of the world's leading companies by tracking the Nasdaq-100 Index. This includes the 100 largest non-financial entities on the Nasdaq Stock Market, including Apple, Amazon, Microsoft, and Google.

The fund has demonstrated strong historical performance, boasting an impressive average annual return of 17.2% over the past decade, significantly outperforming the S&P 500 index. USNQX maintains a competitive edge with a lower expense ratio of 0.45%.

- 10-Year Avg. Ann. Return: 17.39%

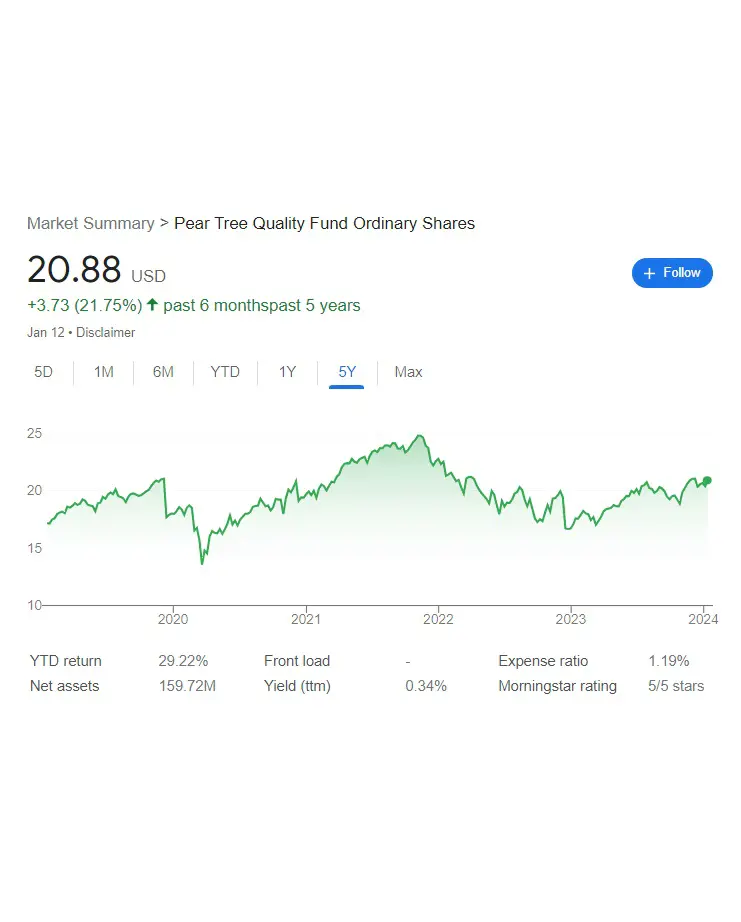

Pear Tree Quality Fund Ordinary Shares

Providing potential for steady growth and relative stability, it is often associated with less volatility compared to smaller companies. With a history dating back to 1985, the fund demonstrates a long track record, indicating experience and consistency in its investment approach.

However, it's crucial to note the expense ratio of 1.19%, which is relatively higher compared to some funds. As of the year-to-date return, the fund has shown a strong performance, with a return of 29.22%, potentially appealing to investors seeking growth in their portfolios.

- 10-Year Average Annual Return: 12.82%

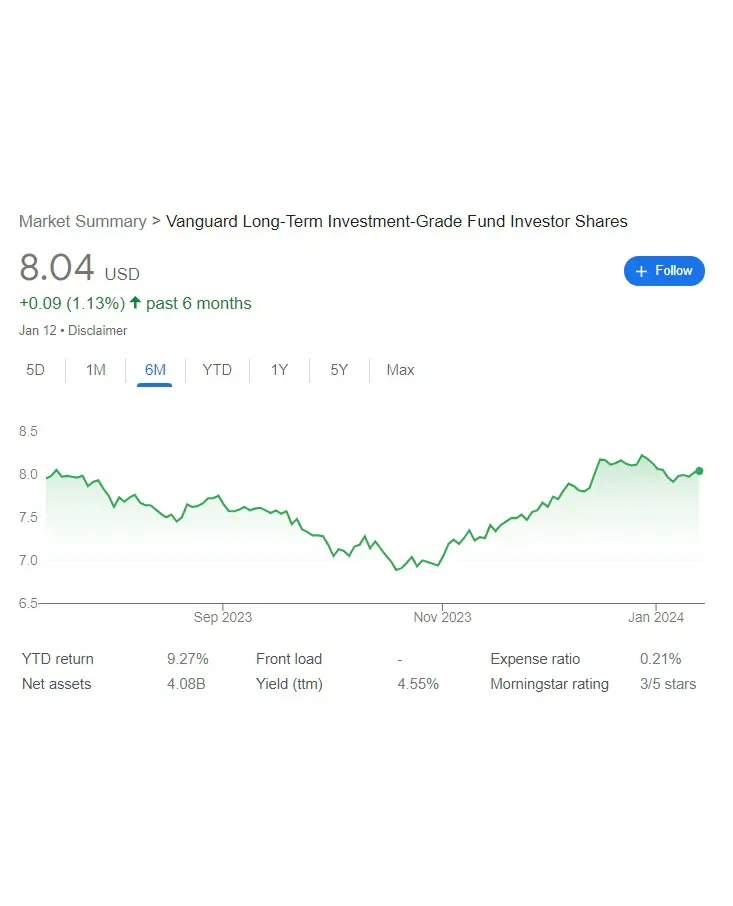

Vanguard Long-Term Investment-Grade Fund Investor Shares (VWESX)

Investing mostly in investment-grade bonds with lower default risk than their lesser-rated equivalents, VWESX focuses on high-quality bonds. The average maturity of VWESX is designed to potentially yield larger returns over the long period as opposed to the shorter term.

With a low expense ratio of 0.21%, VWESX offers a relatively cost-effective avenue for long-term investment-grade bond exposure. Adding to its appeal is Vanguard's renowned reputation for low fees and an index-based investing philosophy.

- 5-Year Average Annual Return: 3.75%