Interest can be a source of passive income or a regular expense, depending on whether it is a return on a loan or investment. Even individuals with only basic finance knowledge can acknowledge that there are various types of interests, such as prime, discounted, variable, fixed, compound, and simple interest rates.

Understanding the different interest rates is crucial when borrowing or investing. It helps to determine how much you’ll end up paying or earning. In this article, we'll cover various forms of interest, helping you to make informed decisions about your financial commitments.

What Is Interest?

Interest is the money paid upon borrowing money or the return earned on investments. It is a financial charge expressed as a percentage of the principal amount over a specified period. When borrowing, individuals or entities pay interest to lenders as compensation for the risk.

Conversely, in investments, interest is the income earned on deposited funds or invested capital. Interest fluctuates based on market conditions, creditworthiness, and the type of financial product involved, impacting the overall dynamics of financial transactions.

What Is The Rate Of Interest?

The rate of interest can refer to several things, depending on the context:

- General interest rate: 5% to 12%

- Specific loan or investment: 3.5% to 10%

- Comparative interest rates: 4.5 to 11%

Understanding these three aspects of interest rates is essential for individuals and businesses to navigate the complexities of borrowing, investing, and financial decision-making.

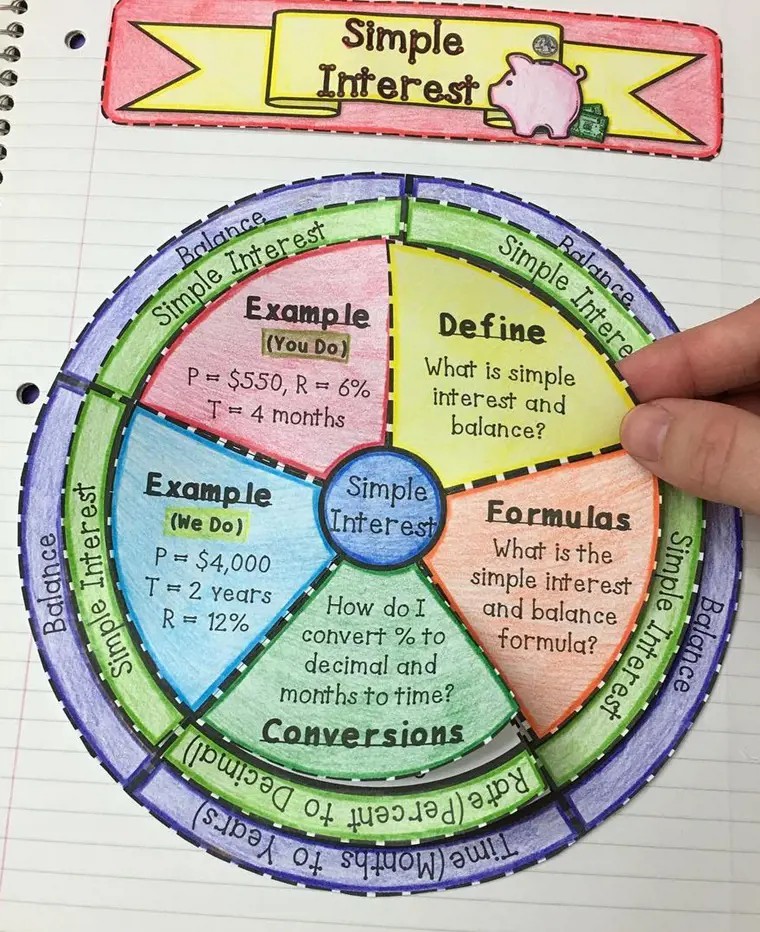

Simple Interest

Out of different types of interest rates, simple interest is the most straightforward way to calculate the earned or charged amount. The interest is only calculated on the initial principal amount. It also means that it typically earns or charges less interest than compound interest over time.

Simple interest is often used for short-term loans, such as payday loans or credit card balances. For example, if you borrow $1,000 at an annual interest rate of 5% for one year, the simple interest would be $50. This is because you would only be paying interest on the initial $1,000.

- Formula: I = P * R * T

Compound Interest

In simple terms, compound interest is referred to as interest on interest. Unlike simple interest, where interest is only earned on the initial principal amount, compound interest earns interest on both the principal and the accumulated interest from previous periods.

This can lead to significantly larger returns over time, making it a powerful tool for growing your wealth. For example, if you took out a loan for $100 with a 5% interest rate, your payments would look a little like this:

- Month 1 – (Starting Balance) £100 + (Interest) = £105

- Month 2 – (Starting Balance) £95 + (Interest) = £99.75

- Month 3 – (Starting Balance) £89.75 + (Interest) = £94.23

Fixed Interest

In contrast to the exciting growth potential of compound interest, fixed interest offers a more steady and predictable financial landscape. With fixed interest, the rate remains constant over the entire duration of a loan or investment.

This stability is particularly advantageous for individuals and businesses seeking a reliable and unchanging framework for budgeting. It allows borrowers and investors to confidently navigate their financial commitments without being susceptible to fluctuations.

Variable Interest

In contrast to fixed interest, variable interest rates based on market conditions or other predetermined factors. They are often tied to benchmark rates, and their variability exposes individuals and businesses to both potential savings and increased costs.

The most obvious benefit of a variable interest rate is that the borrower's interest payments will decrease in time with a lowering in the index or underlying interest rate. On the other hand, interest payments go up if the underlying index rises.

Nominal Interest

It refers to the stated, fixed rate of interest on a loan or financial product, without considering inflation or compounding. It represents the percentage of the principal amount that borrowers pay or lenders receive over a specified period.

Nominal interest is a straightforward measure of the cost of borrowing or return on investment. Unlike APR, it doesn't include extra fees or compounding effects. It's a basic reference point for comparing different financial products.

Mortgage Interest

What is mortgage interest? Typically it refers to the cost of borrowing money to finance a home purchase. When individuals take out a loan to buy a house, they are required to pay interest on the principal amount borrowed.

It is a significant factor influencing the overall cost of homeownership, and borrowers often consider the type of interest rate that best aligns with their financial goals and risk tolerance when choosing a mortgage.

Types of Mortgage Interest

- Fixed-rate mortgages

- Adjustable-rate mortgages

Real Interest

Referring to the interest rate adjusted for inflation, real interest reflects the actual increase or decrease in the purchasing power of the money lent or borrowed. The real interest rate is calculated by subtracting the inflation rate from the nominal interest rate.

This adjustment is important because it provides a more accurate measure of the cost of borrowing or the return on investment. Understanding this interest rate is essential for making informed financial decisions.

Floating Interest

Although this term may sound a little new to you, floating interest is an important idea in finance, especially when it comes to loans and mortgages. Unlike fixed interest rates that stay the same, floating interest rates can change.

They go up or down based on things like how the economy is doing or decisions by the central bank. It means the interest you pay could change over time. This uncertainty makes it important to understand how floating interest works.

Prime Rate

The prime rate is also referred to as the benchmark interest rate. It is the interest rate that banks charge their most creditworthy customers. It is mainly influenced by the broader economic environment and the policies of central banks.

For financial institutions, the prime rate is a key tool in determining interest rates for various loans, including mortgages, car loans, and personal loans. Being aware of changes can be instrumental for those considering loans or monitoring economic trends.

Discount Interest

It refers to the interest charged on a loan or financial product upfront, typically at the beginning of the loan period. This upfront interest is deducted, or "discounted," from the total amount borrowed, resulting in the borrower receiving less than the face value of the loan.

This approach is commonly used in short-term lending or financial instruments like Treasury bills. By starting with a discount, lenders ensure they receive their interest earnings early in the loan term.

Annuity

An annuity is a financial product that provides a series of payments made at equal intervals. These payments can be made weekly, monthly, quarterly, or annually, depending on the terms of the annuity.

Annuities are often used as a tool for retirement planning and are typically purchased from insurance companies. It's essential to carefully consider the terms, fees, and features of any annuity before purchasing, as they can be complex financial instruments.

Types of Annuities

- Fixed Annuities

- Variable Annuities

Per Diem Interest

In the context of loans and mortgages, Per diem interest refers to the daily interest that accrues on a loan. Per diem is a Latin term that means per day. When you have an outstanding loan balance, interest is typically calculated on a daily basis.

It is often used in real estate transactions, especially during the period between the loan closing date and the first regular monthly mortgage payment. During this time, the borrower may be required to pay per diem interest for the partial month.

Per Diem Interest: (Number of Days in a Year/Annual Interest Rate)×Loan Balance

Simple Discount Interest

Simple discount interest is a financial calculation where interest is deducted upfront from the face value of a loan, and the borrower receives the principal amount reduced by the interest. It is often used for short-term loans, such as bills of exchange or commercial paper.

Imagine you borrow $100 from a friend, promising to pay them back in a year with a 10% discount. Instead of paying back the full $100, you only owe them $90. This $10 difference is the simple discount interest.

- Simple Discount: (Principal x Interest Rate x Time) / 100

Precomputed Interest

Also known as simple interest or add-on interest, in this approach, the total interest for the entire loan term is calculated and added to the principal amount upfront. The borrower repays the combined principal and interest in equal installments.

It is more common in certain types of loans, like auto loans from buy-here-pay-here dealerships or loans for borrowers with less-than-perfect credit. While it has the benefit of predictable, fixed payments, it's crucial to compare offers and consider your repayment plans.

Credit Card Interest

If you have a credit card, then you're likely familiar with this term. This is a fee for borrowing money from your credit card company. They charge you interest if you carry a balance after the grace period. Its rates can vary widely.

It's important to know how these rates apply to your balance. Managing your credit card debt wisely can help reduce the impact of interest charges. Always check your credit card agreement to informed decision making and avoid extra costs.